Fintech Governance: Building A Sustainable Future Of Finance [MFA SCP]

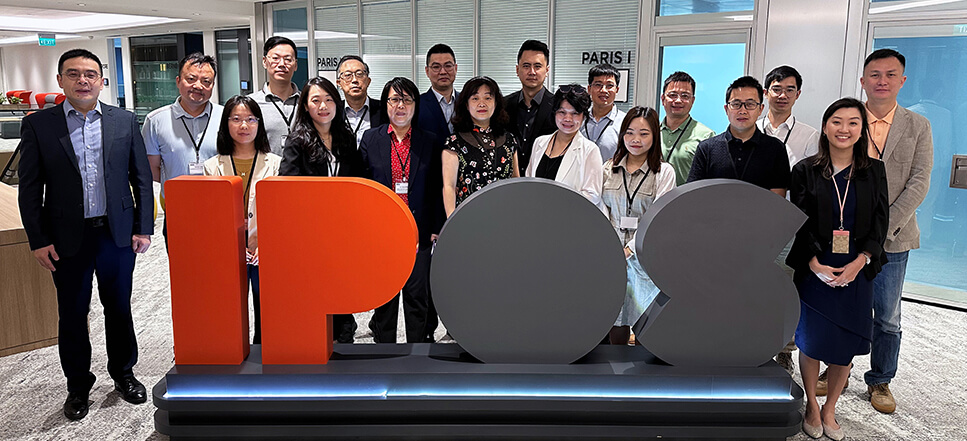

(Pictured above) 27 mid- to senior-level government officials holding management and regulatory roles in finance, digital innovation, and cybersecurity departments across 25 countries together with IPOS International staff

The "Fintech Governance: Building a Sustainable Future of Finance" programme, held from 22 to 26 July 2024, is part of the Singapore Cooperation Programme (SCP) by the Ministry of Foreign Affairs (MFA). Conducted at IPOS International, the programme aimed to provide an in-depth understanding of the rapidly evolving fintech landscape and Singapore's approach to governance, regulation, and innovation in this sector. The course was designed to equip participants from various countries with the knowledge and tools to support sustainable fintech growth in their regions. The programme also included 3 learning journeys to StraitsX, BNY Innovation Centre and MAS Gallery.

Programme title

Fintech Governance: Building A Sustainable Future of Finance

Date

22 – 26 July 2024 (In-person)

Caption: Mr. Reuben Lim, CEO, Singapore Fintech Association sharing on Singapore’s fintech landscape and trends.

Objectives

The programme offered a holistic view of fintech governance, emphasizing the balance between innovation and regulation. Participants were introduced to the latest trends, challenges, and enablers of fintech ecosystems while learning about legal, regulatory, and security frameworks.

Participant Profile

A total of 27 mid- to senior-level government officials attended the programme. The 27 participants represented 25 countries, with more than half holding management and regulatory roles in finance, digital innovation, and cybersecurity departments within their organisations.

Caption: BNY Mellon staff sharing their initiatives with our participants.

Programme Information/Highlights

The five-day programme featured a wide range of topics, from fintech innovations to regulatory responses and intellectual property rights, all designed to equip participants with both essential knowledge and practical insights. Invited speakers from academia, industry, and the public sector share different perspectives and insights with the programme participants.

The programme was structured around key themes, including:

- Overview of Fintech: A comprehensive introduction to Fintech innovations, use cases, and challenges in the evolving digital finance landscape

- Recent Developments and Global Applications of Fintech: Participants explored how fintech is reshaping industries worldwide, with special attention to the economic benefits and risks associated with adoption

- Enabling Ecosystems for Fintech Adoption: Our speakers delved into building a thriving fintech ecosystem, focusing on workforce development, technological infrastructure, and regulatory frameworks

- Economic Impact and Governance Challenges: Case studies on digital money and crypto assets were presented to demonstrate real-world fintech governance and the complex regulatory challenges associated with these technologies

A notable highlight of the course was the inclusion of several learning journeys, which provided participants with firsthand exposure to cutting-edge fintech applications and innovations. The visits to StraitsX and the BNY Mellon Innovation Centre were particularly impactful, offering participants a unique opportunity to see real-world implementations of fintech solutions and engage directly with industry leaders.

The visit to MAS Gallery showcased how MAS lays a strong foundation for sustainable economic growth and develops Singapore as a dynamic and progressive global financial centre. Participants found the experience highly enriching, gaining valuable insights into Singapore's economic development history.

Caption: The MAS Gallery guide showcasing the various exhibits to participants at the gallery.

Caption: Participants at StraitsX — one of the learning journey locations, on the first day of the programme.

Caption: Participants actively engaged in the Q&A session at BNY Mellon.

Caption: Programme participants at the IPOS/IPOS International office.

About the Engagement

This is the first time MFA has engaged IPOS International to run a training programme for mid- to senior-level government officials on Fintech Governance.

About Singapore Cooperation Programme (SCP)

Singapore has provided technical assistance to other developing countries since the 1960s. As a country whose only resource is its people, Singapore believes that human resource development is vital for economic and social progress. Singapore itself has benefited from training provided by other countries and international organisations.

In 1992, the Singapore Cooperation Programme (SCP) was established to bring together under one framework the various technical assistance programmes offered by Singapore. Through the SCP, the range and number of training programmes were increased to share Singapore’s development experience with other developing countries. Working with more than 50 local and international partners, we have shared our development experiences with close to 150,000 government officials from 180 countries, territories and intergovernmental organisations. The SCP is managed by the Technical Cooperation Directorate of the Ministry of Foreign Affairs, Singapore.