Intangible Assets 101 for Startups

Entrepreneurs – the heroes of our new economy [1.] As an IP Strategist, I have had the good fortune to interact with many startup founders in my work. Like heroes in the comic and cinematic universe, a startup founder is perennially faced with a multitude of pressing challenges, such as validating the company’s problem statement, building an A-team and seeking funding to get through `the next six months’. As a result, many founders neglect the management of their intangible assets, which are keys to the company’s unique selling proposition and sustainable value creation. Talking about intangible assets to startup founders usually earns me a puzzled look. Based on these conversations, I would like to share some common questions that startup founders have about intangible assets.

Read also: How Effective IP Management Can Help Your SME

What are intangible assets and why are they important?

The textbook definition of intangible assets is assets that are not physical in nature. These include registrable intellectual property and non-registrable assets, such as those in the table below. These assets are the ingredients for a company’s secret sauce, and every company will have its own recipe.

The importance of intangible assets can be stated simply; they represent the bulk of the value in a startup. To illustrate this, consider a startup that has received seed funding at a valuation of $1M. This valuation would not be based solely on the startup’s physical assets but derived in bulk from the expectation of future value. In turn, the key to unlocking this future value would be the startup’s painstakingly developed secret sauce, which it should jealously guard. This is done by protecting the portfolio of intangible assets which make up the secret sauce, an important element and first step in its overall IP strategy and commercialisation.

As a young startup, do I really have such intangible assets?

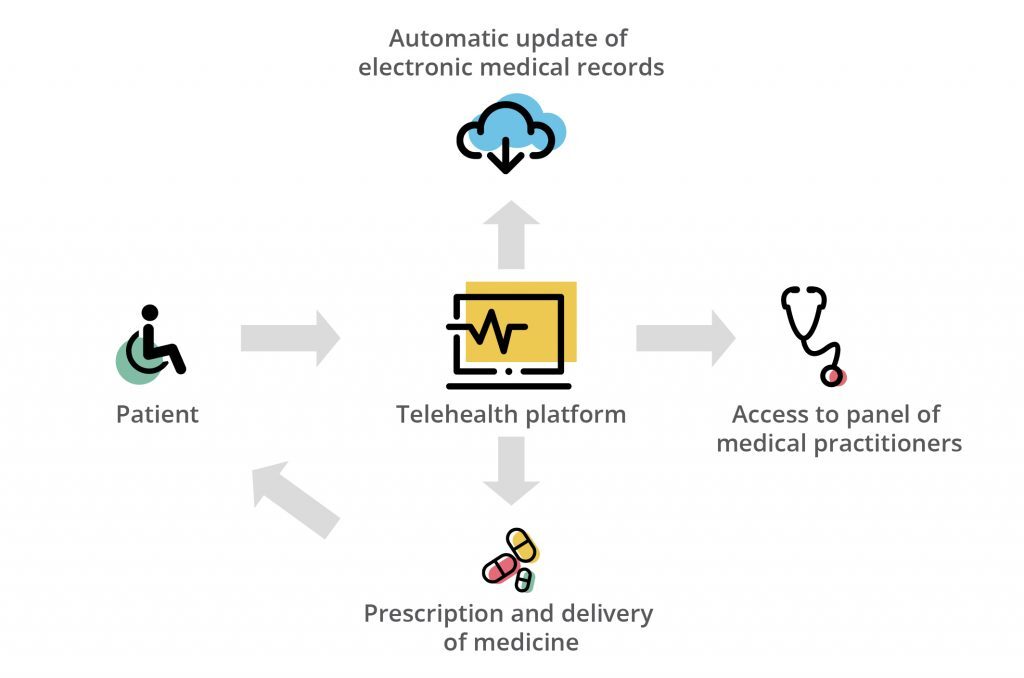

Most startups possess a larger portfolio of intangible assets than they realise. Let’s take the example of a telehealth startup which offers an online platform providing users with access to a panel of medical practitioners for simple and fuss-free consultations (illustrated below).

Such a startup will have:

- Software code for its online and/or mobile platform, which is automatically protected by copyright and can be protected as a trade secret by implementing additional safeguards.

- Proprietary data from collection of user data, preferences and activity, which can be used to improve its product features or monetised in adjacent industries.

- Brand of the startup which creates long-term value for the company.

- Know-how in the heads of key employees who formulate the algorithms and design the user experience of the platform.

- Key relationships such as those with key opinion leaders who can influence medical practitioners to join the platform.

These are just a few examples. Startups in the hardware space will likely possess an even larger portfolio of intangible assets, such as patents and registered designs, to protect the functional and aesthetic design of its product.

Not sure if your business has intangible assets that need to be protected? Check out our complimentary business guide - Safeguarding Your Competitive Advantage

Is it really that important to manage these intangible assets now? I have other priorities!

As a busy entrepreneur, the management of intangible assets may not appear to be a pressing need. This is because the repercussions of not managing the startup’s intangible assets well are unlikely to be immediate. Instead, the repercussions manifest after the startup has achieved some success. Consider the following scenarios using the same telehealth example:

-

Software code

When conducting due diligence on the startup in preparation for a Series C round, the VC discovers that the telehealth platform was built on copyleft software, and the startup is obliged to publish its software for free. This causes the valuation of the company to plunge (see Artifex v. Hancom).

-

Brand

The startup has achieved moderate success in Singapore and gained some brand recognition. The next step of the startup’s growth is to expand overseas. In preparation for this, the company applies to register its logo in its markets of interest, only to realise that the logo has already been registered by a third party. The startup is forced to acquire the logo from this third party for a fee (see Apple v. Proview) or spend an inordinate amount to rebrand itself in the new market, thus losing the brand equity it could have leveraged.

-

Trade secret

A key employee leaves for a competitor and implements a core algorithm from the startup in the competitor’s platform, greatly eroding the company’s competitive advantage (see Uber v. Waymo). These scenarios can derail your startup at a stage when it is supposed to be scaling up. However, they can be avoided by managing your intangible assets early. In addition, having a good grasp of your intangible assets — the ingredients of your secret sauce will allow you to articulate the value of your startup to investors clearly and lessen the pain of the due diligence process.

Read also: Reimagine Your Business with IP

I’m convinced that I should start managing my intangible assets early, but have heard that IP protection is really expensive?

A good intangible asset management framework will take into account your business model, budget considerations and protection needs. Not all intangible assets can, or should be, protected by obtaining formal registration (e.g., patent, trade mark and registered design protection). Some intangible assets are better protected in the form of trade secrets, which do not entail any registration fees but a stringent policy. The perception of the high cost of protection for intangible assets mainly stems from high patenting costs (that said, there are ways to delay the cost of patent protection). Trade mark and registered design registration fees are actually quite moderately priced. By considering all options of intangible asset protection holistically, startups should be able to arrive at a protection strategy that fits within their budget.

Begin today

I hope that the answers to the questions on intangible assets above have helped resolve some of your own. As a startup founder, your intangible assets are what power your company. Do not let the neglect of these assets take the magic off your unicorn prematurely. Start identifying and managing your most important assets today.

[1] https://www.straitstimes.com/business/a-new-singaporean-hero-must-be-the-entrepreneur-ong-ye-kung

Book a complimentary chat with us to learn how you can leverage on your IP. test

Book IA Chat Session