Getting Your Money’s Worth from Intangible Assets in Non-Fungible Tokens

This article was first published in the Oct-Nov 2021 issue of the Asia Franchise & Business Opportunities Magazine published by Asiawide Franchise Consultants Pte Ltd.

In March 2021, Mike Winkelmann—the digital artist known as Beeple, sold a Non-Fungible Token (NFT) of his digital artwork for a staggering US$69.3 million.[1] Hosted and verified by Christie’s auction house, the record sale was made to entrepreneur Vignesh Sundaresan, also known as MetaKovan.

This significant milestone in digital art history is part of the rising trend for sales of NFT. In fact, it was reported that sales of NFTs over the first half of 2021 have surged to US$2.5 billion from just US$13.7 million in the first half of last year.[2]

What exactly is this NFT technology that is making waves in the digital art world? Who owns the rights to use the intellectual property (IP) in these tokenised digital assets after purchase? And what does the rise of NFTs mean for businesses?

Examining the traits of an NFT

An NFT is authentic and unique: An NFT is a unique record on a blockchain that is configured to perform the function of a ledger. This ledger tracks the record of ownership and transaction history of each NFT and is also linked to a copy of a digital asset.

In MetaKovan’s case, the auctioned NFT would be linked to a copy of the underlying artwork (a digital file). Since it is very difficult to amend an existing blockchain record, the authenticity of the NFT including its link to the underlying asset is often undisputed.

Further, because an NFT is a unique record, meaning no two NFTs are identical, an NFT is therefore non-fungible – distinct and non-exchangeable.

An NFT can be linked to a digital asset: Digital art, collectibles, in-game assets (card collection), musical works, films, memes, and patent disclosure forms – all in digital format – have been used as underlying digital assets of NFTs.

While an NFT is authentic and unique as a record (on the blockchain ledger), the underlying digital asset may not be so. What is linked could be counterfeit or doctored, and even if original, exist elsewhere in multiple copies.

Further, for most NFTs, the underlying digital work is likely hosted outside the NFT platform (outside blockchain) as it is resource-intensive and expensive to incorporate the digital file into the NFT. As a result, owning an NFT does not automatically mean that you gain control over the use of the linked digital asset.

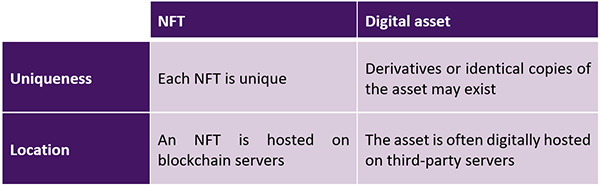

This table summarises some differences between an NFT and its underlying digital asset.

Throwing light on the ownership of an NFT

The buzz surrounding NFTs may have come about as buyers have been sold on the notion of owning something unique in the digital space. What buyers may not realise is that despite NFT ownership, any legitimate use of the underlying digital asset is subject to the terms and conditions of the sale. In a bid to drive demand for NFTs, advocates may be tempted to gloss over details relating to IP, including both the ownership and licensing of IP.

For instance, Mike Shinoda of Linkin Park, a rapper and media producer, reportedly said in an interview:[3] “[j]ust embrace [NFT]. It’s not about the physical item. It’s about the concept of ownership.”

In a case involving DC Comics characters, the creator of the NFT-ed assets, who had made US$1.85 million from NFT sales, was sent a demand letter. A leaked copy of the demand letter states:[4]

“As DC examines the complexities of the NFT marketplace, and we work on a reasonable and fair solution for all parties involved, including fans and collectors, please note that the offering for sale of any digital images featuring DC’s intellectual property with or without NFTs, whether rendered for DC’s publications or rendered outside the scope of one’s contractual engagement with DC, is not permitted.”

In the circumstances, it is increasingly important to draw a distinction between these two types of ownership:

• ownership of the NFT; and

• ownership of IP rights of use (in the digital assets), which include rights relating to copyright, trade marks and even patents.

While the copyright owner of a digital artwork has exclusive rights to reproduce and communicate to the public the artwork, the owner of an NFT linked to this artwork is by no means automatically conferred any such rights. The NFT owner may come to possess such right of use only in accordance with a separate agreement with the copyright owner or, where applicable, his licensee.

In other words, IP-related rights of use, including licensing, remain subject to established legal rules and formality. For example, a Singapore exclusive copyright licence must be in writing and signed by the copyright owner for it to be effective.

On the other hand, the rights and privileges relating to NFT ownership are largely subject to the control of the NFT provider and the rules that have been programmed into the NFT system. Such programming is also known as a “smart contract”, since the system may be programmed to “self-execute” contractual terms. However, the word “smart” in smart contract may cause misunderstanding since the system is unable to make decisions beyond its programming.

A smart contract is likely no replacement for a legally enforceable contract since it is often impractical to decipher what the agreement terms are from the computer code and there can be no agreement if the terms are not decipherable.[5] Owning an NFT is thus analogous to owning a Facebook or eBay account by a user, where the user’s rights are subject to the platforms’ terms of use.

Even though NFTs are practically immune to alteration, an NFT owner is not guaranteed perpetual access to the underlying digital asset, especially if the owner does not also control the network that is hosting the asset. This much is noted in Wikipedia’s entry for NFTs stating that “data links that point to details like where the art is stored can die”.[6] Prospective NFT buyers may wish to consider this risk before entering into a deal.

Looking to IP to safeguard an NFT buyer’s interests

While it is not clear whether MetaKovan obtained exclusive rights to use the artwork he paid millions for, or just bragging rights, in a more recent report the buyers of a US$24.4 million auction sale hosted by Sotheby’s did in fact acquire IP rights to the underlying digital assets, specifically the Bored Ape Yacht Club collection which includes 10,000 computer-generated images of cartoon apes made by the US-based company Yuga Labs.[7]

In another move that further signifies the growing importance of IP in an NFT sale, standardised IP licences (for NFT transactions) were published for general adoption. An example of such licences is the NFT licence template published by Dapper Labs (which described itself as “The NFT Company”SM), which provides that the NFT buyer would be permitted to use the underlying asset artwork for the buyer’s own “personal, non-commercial use”, and on “a marketplace that allows the purchase and sale of [the NFT], so long as the marketplace cryptographically verifies [ownership]”.[8]

As the value and use of a digital asset are closely related to IP rights, IP due diligence should not be ignored for the purpose of safeguarding a buyer’s interests, especially where the purchase price is substantial.

Before closing an NFT deal, a potential buyer may wish to consider the following:

- Conducting a thorough review of the terms and conditions governing the sale of the NFT;

- Whether the NFT seller possesses the rights to confer purported rights of use on the NFT buyer;

- Whether there is anything in the underlying asset that may be subject to third parties’ IP rights; and

- Valuating the NFT, including its underlying digital asset.

Riding the wave of NFT technology for business growth

While it may be the case that NFTs of today are largely used to create buzz and an additional platform for merchandising digital assets in the form of digital collectibles and digital art pieces, the use of digital tokens is still likely to rise, especially in view of the rapid pace of technology. In fact, digital tokens may have made inroads into the physical world. Case in point – in Nike’s recent patent on cryptographically secured digital assets, these digital assets were proposed to be utilised for products in the physical world in that these digital assets are designed to be representative of a physical retail product.[9]

So, how can businesses better prepare themselves to ride this new wave of technology for growth?

Today, being business-savvy means being also IP-savvy. Start by clearly identifying the IP and other intangible assets that you own and having their value assessed. You may then plan how to actively use them whether directly by your business or through your potential partners.

As NFTs become more pervasive and involve assets of increasing value, the need for effectively unlocking the value of IP in tokenised assets cannot be overstated.

[1] https://www.seattletimes.com/business/crypto-whale-in-singapore-is-buyer-of-69-million-beeple-nft/ (last visited on 14 September 2021)

[2] https://www.reuters.com/technology/nft-sales-volume-surges-25-bln-2021-first-half-2021-07-05/ (last visited 22 September 2021)

[3] https://press.warnerrecords.com/wp-content/uploads/2021/03/Mike-Shinoda-Press-Doc.pdf (last visited on 14 September 2021)

[4] https://gizmodo.com/dc-comics-tells-artists-to-stay-out-of-nft-business-or-1846466427 (last visited on 14 September 2021)

[5] Also see this article at: https://www.forbes.com/sites/davidblack/2019/02/04/blockchain-smart-contracts-arent-smart-and-arent-contracts/?sh=5b69cc0a1e6a (last visited on 14 September 2021)

[6] https://en.wikipedia.org/wiki/Non-fungible_token (last visited on 14 September 2021)

[7] https://www.straitstimes.com/world/europe/set-of-bored-ape-nfts-sell-for-328m-in-sothebys-online-auction (last visited on 14 September 2021)

[8] https://www.nftlicense.org/ (last visited on 14 September 2021)

[9] https://patentimages.storage.googleapis.com/ec/cc/02/52454fa5b0725e/US10505726.pdf (last visited on 14 September 2021)

Book a complimentary chat with us to learn how you can leverage on your IP. test

Book IA Chat Session